Climate change: the new private-sector led asset class?

This week global advisory and insurer, Willis Towers Watson (NASDAQ: WLTW), launched in tandem with governments including the UK and Jamaica, the Global Commission on Adaptation and the World Economic Forum, a private-sector led Coalition for Climate Resilient Investment.

The definition of climate-resilient infrastructure investment will need more explaining or at least more fine-tuning,...

DeVos’ OAPC latest family office to take stake in private equity firm

Signs that family offices will keep overall portfolio allocation in private equity at or slightly above 15% are expected to continue as interest rates stay low and uncertainty and volatility in global public markets and geopolitics prevail into 2020.

This allocation away from the traditional asset classes of equities and fixed income improved...

UK business investment falls for the sixth quarter and UK credit conditions ‘tightening’ for SMEs, says BOE report

Business investment

in the UK had fallen by 0.5% in 2019 Q2, and had now declined in five of the

past six quarters, according to The Bank of

England’s Monetary Policy Committee (MPC) meeting ending on 18 September 2019, which

also voted unanimously to maintain Bank Rate at 0.75%.

Contacts of

the Bank’s Agents had continued to report...

Blue-Chip Artists to Invest in This Month: Will you bank on a Banksy?

BANKSY (B. 1975)

Morons (Sepia)

screenprint in colours, 2007, on Somerset wove paper, signed in pencil, numbered 69/300, published by Pictures on Walls, London, with their blindstamp

Photo Source: Christies

Sector spotlight: Global surgical robot market to grow to $24bn by 2025

News of Europe’s largest private financing in the medical technology sector to date puts the surgical robot industry in the spotlight as a growing number of firms in the sector look to raise more capital to continue research and development, manufacturing and expansion in domestic and international markets.

CMR has raised approximately $384.8m to...

Are Spanish renewables losing out on asset valuations?

Augusta, which has managed transactions to an aggregate value of

over €10bn throughout Europe, highlights in its report the limitations of an

insular approach, whereby Spanish asset owners selling on projects are choosing

to engage in bilateral discussions with familiar investors, rather than seeking

to broaden the pool of prospective buyers – both domestic and international –

via a Structured Sales Process.

Gojek attracts AIA investment to launch into life and health insurance sector; Amazon and Gojek in preliminary talks

AIA Financial and Gojek will work together to

"provide life and health insurance services and wellness propositions to

its users, drivers, and merchants across Indonesia.”

Other series F round investors include Visa. The two companies will work together to provide greater options on cashless payments and more seamless experiences for consumers across Indonesia and Southeast Asia...

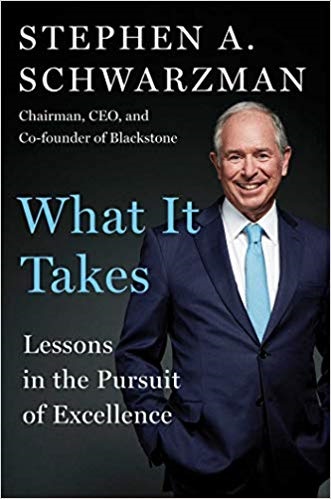

Blackstone founder bestows life lessons in self-help memoir

From educating German Chancellor Angela Merkel on the benefits of private equity-backed businesses to overturning single-gender education at his alma mater Yale, the book has been described as a memoir filled with life lessons.

https://www.cnbc.com/video/2019/09/17/blackstone-co-founder-stephen-schwarzman-autobiography-squawk-box.html

AlbionVC bags 10X return on PSE sale to Siemens

AlbionVC, the technology investment arm of Albion Capital Group, has reported today that Siemens plans to acquire portfolio company, Process Systems Enterprise (PSE), a UK-based Advanced Process Modelling (APM) software and services business. The exit represents a return of c.10x for the Albion VCTs.

According to Crunchbase, PSE has raised just over $3m from...

Where’s the beef?

Meat alternative brand, Beyond Meat, has seen stellar investment popularity since it floated in May.

The market for alternative meat could hit $140bn over the next decade, according to Barclays analysts. The growth trajectory indicates that the "animal-free" segment could capture about 10% of the $1.4 trillion traditional global meat industry.