Wealth managers: your intuition about your clients could be off, says new research

Too many wealth managers rely on intuition to determine client psychological profiles, Oxford Risk research shows

New European research from behavioural finance experts Oxford Risk reveals that wealth managers admit to being regularly surprised by their clients’ investment decisions despite claiming to have a very good understanding of their psychological profiles.

Pension funds switch investments to hedge against inflation

83% of pension fund managers expect inflation to increase over the next 12 monthsAlmost all (98%) pension fund managers believe their schemes are already well hedged against inflation, largely because they have switched investments

New research has revealed that almost six in ten (57%) pension fund managers are predicting further dramatic increases in inflation...

Alternative fund managers: it might be time to brush up on your Italian

More of Italy's pension funds will follow the footsteps of Foncer, Fondo Gamma Plastica, Fopen, Fondo Pensione Complementare Pegaso and Previmoda by increasing investments in alternative funds, it has been reported by think tank Itinerari Previdenziali. The above-named pension funds have recently committed €168m to invest in infrastructure through a project called Vesta.

According...

M&A spikes as uncertainty remains

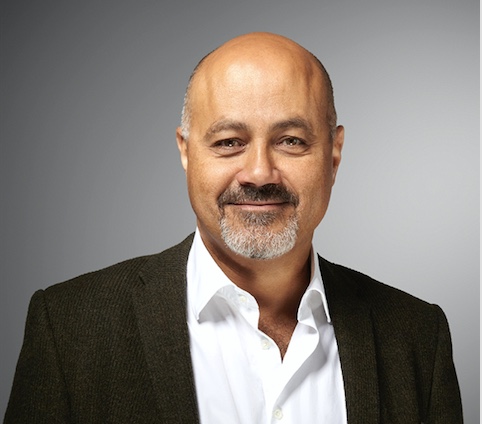

By Victor Basta, Co-Head, DAI Magister

Over the last few months, we’re seeing more and more buyers ‘show up’ well prepared and ready to transact before a target begins any M&A process. In many cases, especially for quality targets in key sectors, we’re seeing multiple buyers appear around the same time. We think...

Barclays enters self-employed mortgage market

Kensington Mortgages, a specialist broker and lender to the UK's self-employed, has been sold to Barclays Bank UK PLC. The acquisition will allow Barclays to become one of the few major banks with a specialist mortgage offering and provides an exit for Blackstone Tactical Opportunities and Sixth Street.

The sale follows an auction...

NFT “rug pull” scam caught on video

NFT adoption in the corporate blockchain could come to a halt if more "rug pull" scams arise. In a Sifted article, Demetris Papadopoulos, a marketing consultant and YouTuber who lives in Athens, relays how he lost $1,200 last October when he tried to buy a picture of a cartoon monkey online.

"It was another...

Crossborder M&A to shrink 80% by 2030

"If a portfolio manager teleported from 2020 into 2030, they would most likely not recognise their industry."

Asset managers will increasingly struggle to run global enterprises, as cross-border investments shrink, according to new research.

Globalization and cross-border M&A in the asset management industry will atrophy by 2030, with less...

The Pallo Backstory: The Freelancers That Launched An App To Fix Their Biggest Problem

I came across a fintech startup called Pallo over on Product Hunt. It wasn’t just the product that intrigued me, but the freelancers-turned-founders’ back story.

Pallo, an AI integrated business and personal finance app designed by freelancers for freelancers, promises to be a game-changer for independent workers. Some of the first questions that come...

Private equity preps for greater SEC scrutiny on fees and LP side letters

Industry experts estimate that investors pay private equity and hedge funds more than $250 billion a year in fees and expenses, which does not take into account additional ancillary fees from limited partners and portfolio companies (Source: JD Supra).

Let's digest that figure for a moment. Think of the domino effect greater SEC...

BuzzVestor Media connects the dots…

From brainstorming your website's purpose to supplying its thought leadership content, we're here to help...